Branding is often intangible. It describes how something makes us feel or the ideas it evokes in our minds. That intangibility can make branding easy to brush off. Yet, it’s what makes branding so powerful. After all, the ability to create those emotions is the difference between someone picking your product and leaving your competitor’s item on the shelf.

How then, does branding come about?

While there is no simple answer to this, one of the core components to getting brand right is tone and voice. This describes the words, style, and emotion a brand uses to convey a particular message to its audience. Relying on trial and error to get your brand voice and tone right takes too long and is ripe with uncertainty. However, with a little market research, you can find the brand tone and voice that will hit a bullseye with your customer segment in no time at all.

Why Consider Brand Voice & Tone

Investing in branding takes time and money. As a result, you need to feel confident it’s the right investment. Let’s look at two critical reasons brand, and the voice and tone that define it, matter.

Market Differentiation Are you in a crowded industry or category? How can you set yourself apart? At the product development stage, you can absolutely point to certain features or benefits that make your products different from the competition. But sometimes, features aren’t so different. This is where brand voice and tone can set you apart.

Consider two very different brands in the antiperspirant category: Axe and Degree. Axe uses a cheeky tone and talks about using Axe to help get the guy or gal you want. In sharp contrast, Degree uses active, direct language and talks about its products letting you stay dry while active. These products functionally do the exact same thing. However, through differences in brand voice and tone, they are able to create unique impressions of what they stand for.

Customer Targeting Related to market differentiation is the idea of customer targeting and customer segmentation. There is likely a large range of people who may consider buying a type of product. However, what drives them intrinsically may be very different.

Through the right brand tone and voice, you can attract a very distinct segment. Implicitly, it means you accept not getting a certain group of customers. But, in doing so, it makes you much more interesting and exciting to another group.

How To Perform Brand Voice & Tone Research

Let’s look at the standard approach for homing in on the right brand tone and voice for your business.

Step 1: Isolate Who You Want In Your Study When we recruit participants into a study, we first need to determine who to survey. If you know the distinct customer segment you want to appeal to, be sure to recruit individuals with the demographic and psychographic criteria that meet that segment.

In contrast, if you want to see how different tones and voices appeal to different segments within a broader audience, you can recruit people with more generic criteria. Let’s use our antiperspirant category as an example. If these brands want to know how different types of tones and voices appeal to different male purchasers, they can simply recruit participants that self-describe as men and as having purchased antiperspirant products.

Step 2: Create Unique Brand Voice & Tone Blurbs This step is frequently the most challenging part of the brand voice and tone research process. This is where you develop the different ways to talk about your brand that align with unique tone or voice ideas. For instance, let’s say you’re wondering if your brand should be brash and roguish or sly and clever. You’ll want to write up blurbs describing your brand’s products that take on these unique bents. This is not easy. This stage requires a lot of revisions before you’re confident that you have the write testing materials.

Step 3: Create Your Research Approach Once you know what you want to test, you then need to determine how to test it. While a lot of nuance is possible in research methodologies, there are two core approaches you’ll likely choose between.

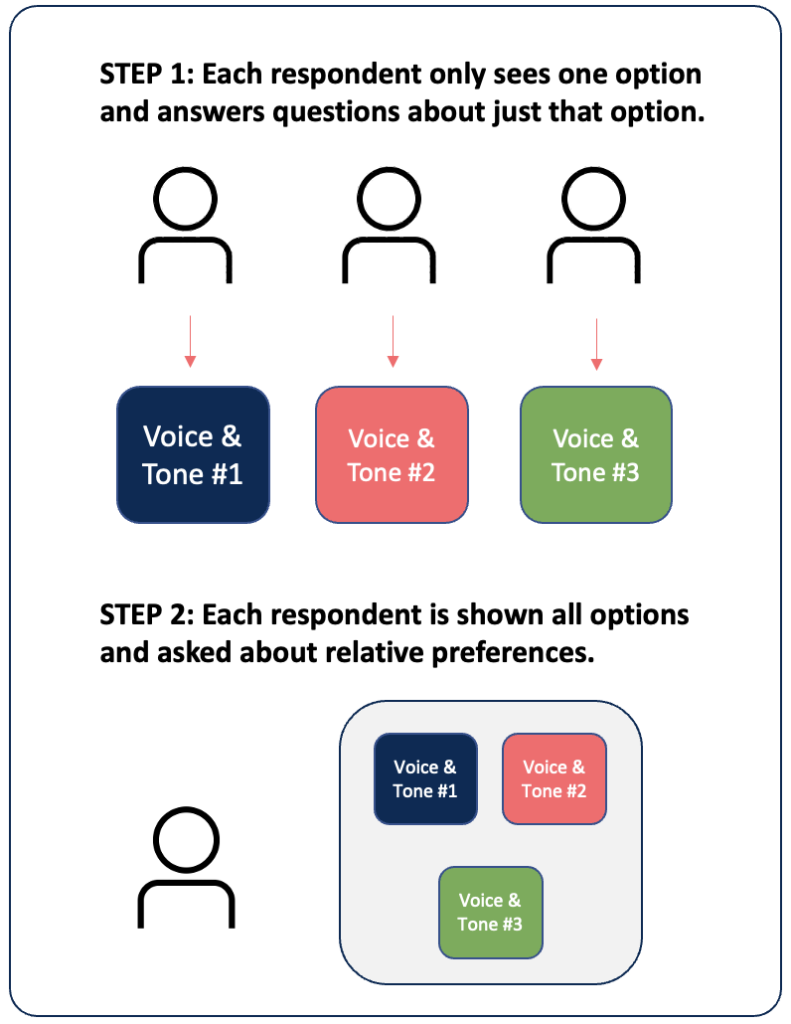

Approach 1: Monadic Testing The term “Monadic” is a fancy research term that just means a participant sees one isolated idea or concept. When it comes to brand tone and voice research, it means that each respondent sees just one of the different blurbs you want tested. They then answer a series of questions about just that blurb. For instance, questions about overall appeal and purchase consideration.

As an optional add on, respondents may then see all blurbs together and to select their preferred option.

Let’s talk about the pros of this option:

- Unbiased answers: When respondents see just one concept in isolation, they have no other concepts in mind. This means they can offer clean, unbiased responses.

- In-depth questions and follow ups: With this approach, you are mainly focusing on just one concept. As a result, you can ask much deeper questions about the concept and still keep the survey duration fairly short.

Now, let’s talk about the cons of this option:

- Larger sample sizes: Each concept must be seen be enough respondents to capture statistically significant reads. As a result, this approach requires larger upfront sample sizes.

- Challenging with niche markets: If your product is for a niche market, it is hard out of the gate to get respondents. As a result, it may be impossible to even find the sample you need given this approache’s requirement of larger sample sizes.

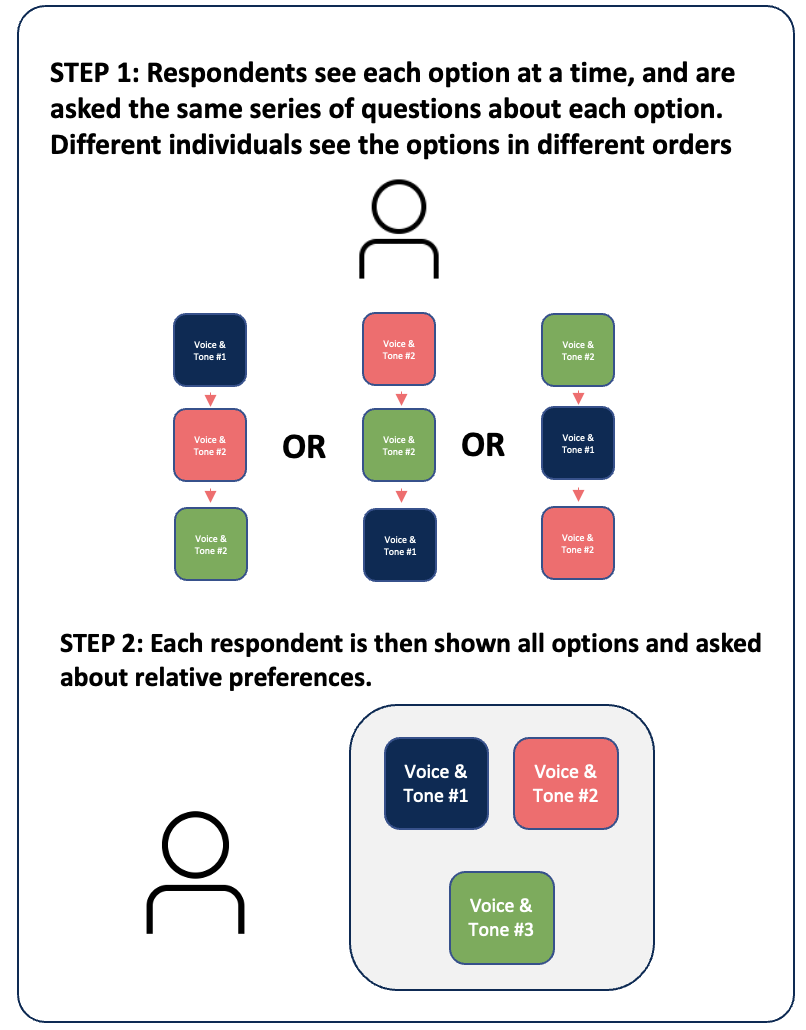

Approach 2: Sequential Monadic Testing A sequential monadic test means showing survey participants a single blurb in isolation, and asking them a series of questions about that blurb. They are then shown the next blurb, and asked the same series of questions. This process repeats until all blurbs are shown. Ideally, the order of the blurbs is randomized to avoid order bias.

Again, we can include the add on option of asking respondents to select their preferred or least preferred option.

Let’s talk about the pros of this option:

- Smaller sample sizes: Under this approach, each respondent sees each brand voice and tone blurb. As a result, you’ll gather feedback faster for each blurb with a smaller sample size. This means you need fewer respondents in your research study.

- Ideal for niche audience: Because this approach allows for smaller sample sizes, it can be better when needing to recruit more unique or difficult-to-find participants into your study.

Now, let’s talk about the cons of this option:

- Longer survey length: This approach requires respondents to see each and every blurb, and answer the same series of questions about them. This inherently increases the time needed to complete the survey which can increase survey costs and also increase survey drop out rates.

- Less in depth questions: To control for survey length, you can decrease the number of questions asked per blurb. However, this also means getting less data per blurb to help inform your decisions.

Step 4: Determine What You Need To Know About The Tones & Voices Presumably, you chose to test tones and voices you think will resonate strongly and differentiate your brand from others. To test this, you’ll need to ask questions that let you validate your hypotheses. Classic questions asked during these types of tests probe on tone and voice likability, believability, and fit with a particular brand or product category.

By asking these questions about each blurb, you can see how each blurb rates across these dimensions.

How To Pick A Brand Voice & Tone

We’d love to tell you that doing this kind of market research yields no-brainer answers. Sometimes it does. But, sometimes it doesn’t. What frequently happens is some voices and tones rate high for some dimensions but lower for others. It can lead to ambiguity about which direction to take.

When faced with this uncertainty, we suggest asking a one key question: Which dimension matters most? If you’re in an extremely crowded category, “being different” may be critical. However, if you’re in an extremely novel category, “being believable” may be more important. Figure out what is most important to your business. With that in mind, you’ll be able to prioritize the findings and pinpoint the best choice.