Do you know how customers benefit intrinsically when they use your brand or product? Or, at the very least, what they hope they’ll get from using it?

Sure, you can ask. You could even do classic word association games to let them make those connections themselves. However, there’s a problem to this general approach. The same sets of words and phrases mean different things to different people. As a result, if you just ask them and use this feedback in your marketing messaging, you may find yourself headed down the wrong path.

Your messaging and imagery won’t completely fall flat with customers. But it won’t evoke the right ideas either.

Leveraging metaphor elicitation, a unique form of marketing messaging research, overcomes this challenge. This approach zeros in on deeper thoughts and meaning behind language and images, letting marketing and branding professionals glean the insights they need to produce impactful messages and imagery.

Why Use Metaphor Elicitation In Marketing Messaging Research

Based on the work of Harvard Business School Professor Gerald Zaltman, metaphor elicitation dives a level deeper than classic name association research. It requires a lot of heavy lifting in the form of parsing through free response text. But, it’s worth it for two key reasons:

- No Misinterpretation: The same word can mean different things to different people. For instance, how one person defines “collaboration” may be very different than how another person interprets it. As a result, just using word associations leave us open to misinterpretation. Going a layer or two deeper gets us past this misinterpretation point.

- Deeper Meanings: When respondents explain what a word or image means to them, we hear in detail how they describe it. It lets us dive into intrinsic sentiment by pinpointing metaphors or other language that unearths subconscious feelings.

How The Metaphor Elicitation Process Works

Marketing messaging research based on metaphor elicitation starts with word associations. However, it then goes quite a ways further.

Step 1: Brand & Category Adjectives Association

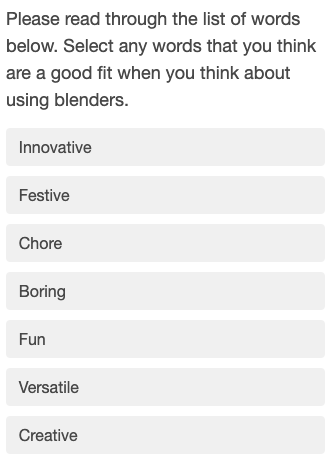

We first develop a list of adjectives that describe a brand’s core category. For instance, if our brand is Vitamix, our category is blenders. We then come up with a variety of adjectives we think pair well with blenders. For instance, these could include words that describe blender technology or functionality. Or, they could be words associated with how a blender makes someone feel or the events associated with blending.

Respondents see this full list of adjectives. They then select the words they associate with blenders. An example of this is on the right.

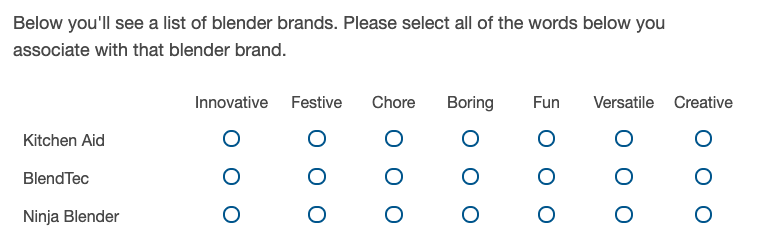

We then ask respondents to select which of these adjectives align to particular blender brands. Normally, we suggest limiting the brand list to 5 or 6. Any more than that and respondents get overwhelmed.

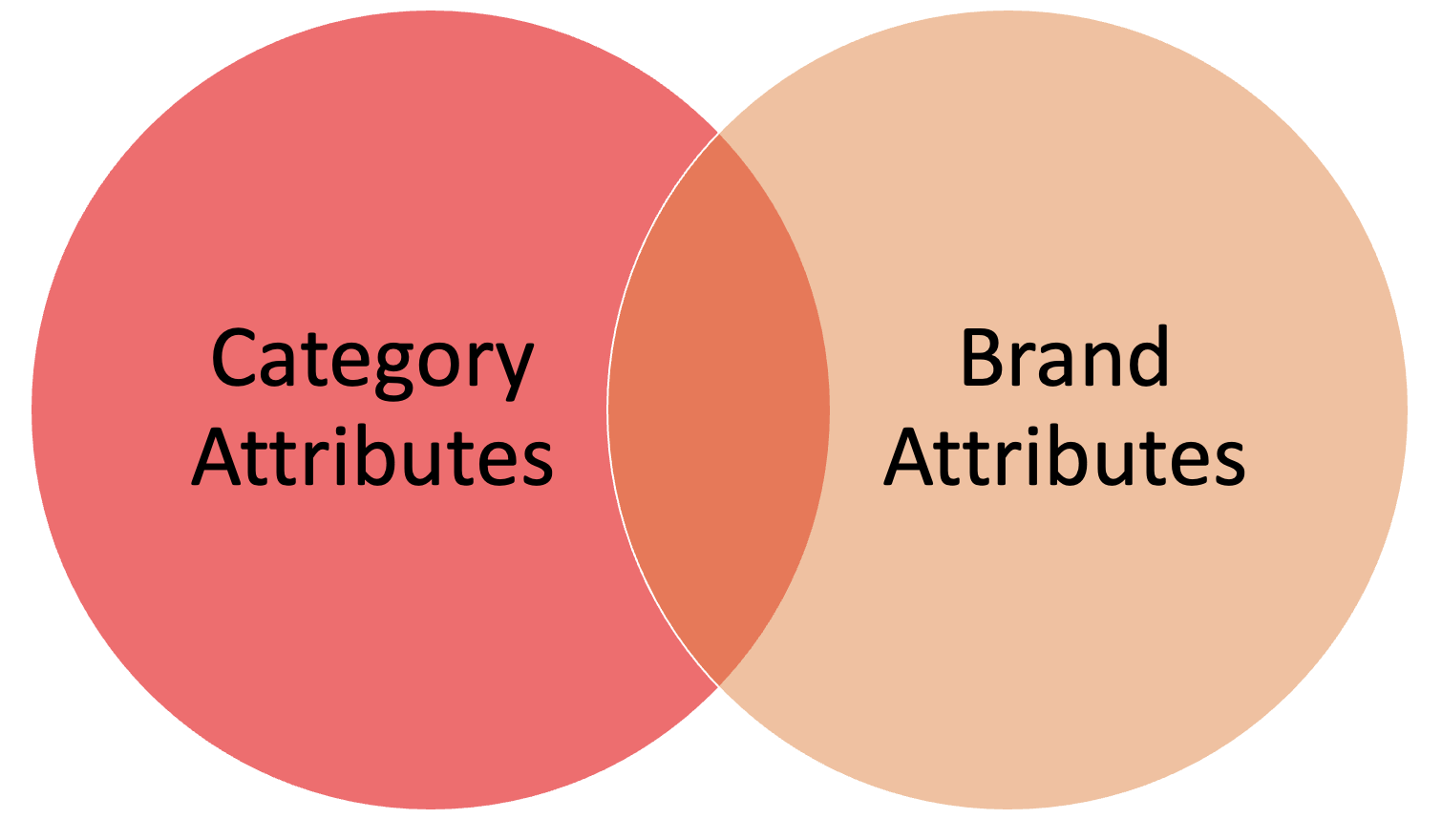

Why this two part process? Because it lets us see attribute association overlaps. We see what attributes customers associate with our core brand and also competitor brands

If there are certain positive words our brand “owns” that others don’t, this means there are opportunities to strengthen this association. Relatedly, if our brand owns certain negative words, we know there’s work needed to counter that impression.

As important as this overlap is, the lack of overlap is just as important. There could be adjectives you’d expect to see respondents associate with brands but don’t. These are possible opportunities to co-opt certain ideas or sentiments via branding and messaging to begin market differentiation.

However, as we’ve already mentioned, we can’t just stop at asking for word associations. After all, what if the way Person A interprets a word is different than how Person B interprets a word? The aggregated quantitative data will point towards a certain association. Yet, this data may not truly represent our respondents’ intent.

This is where the metaphor elicitation process comes in.

Step 2: Free Response Capture

For each word respondents select earlier in the survey, respondents select an image that best matches that word.

What follows are two additional questions. The first asks the respondent to describe the image. The second asks them about how or why they associate the image with a particular word.

For instance, if the respondent selects the spaceship image, they might write: “I see a space ship flying in space. It’s off the ground and now it’s orbiting the Earth.”

For the second question, we may see a response like: “This represents cutting edge technology. Man has been on Earth for thousands of years, but we’ve only been in space for a few decades. It took a lot of ingenuity and trial and error to put a man in space.”

We repeat this process across all respondents, leaving us with a text-rich set of data to review. This lets us delve into individual responses, isolating deep meaning and metaphors used in each explanation.

Step 3: Language & Metaphor Exploration

Let’s use our earlier response as just one example. The term “cutting edge” appears. This shows that the respondent associates Innovation with advanced ideas that are ahead of any other ideas. Further, they use terms like “trial and error” which tells us they also associate Innovation with persistent work and overcoming barriers to success.

As you can see from just this one example, we begin to incorporate the “art” into the science of market research. By picking apart the use of particular words and metaphors, we isolate the deeper meanings customers associate with broader ideas.

Linking Metaphor Elicitation To Messaging & Imagery Usage

Of course, we don’t just do this work for the sake of understanding how respondents intuit certain words or phrases. We’re doing this research to ultimately tie back to marketing messaging and imagery.

We’ll keep using the idea of Innovation to show how this syncs together. Let’s say that after reviewing the open text responses, the idea of newness keeps appearing. That is, responses use metaphors like “being on the cutting edge” or “being the first on the block.”

This tells us that the messages and images associated with telling the brand’s story must bring newness to the forefront. They could incorporate how the brand continually offers new features that competitors don’t. Or, they could emphasize how the brand makes a person feel like they are doing something new and different. Even deciding on whether to emphasize intrinsic ways innovation makes one feel or extrinsic markers of innovation is something brands can glean from this work.

Applying Metaphor Elicitation For A New Brand's Messaging

If you’re wondering if this approach works when doing messaging or branding for a completely new brand, the answer is simple. Yes, it sure does!

In the example above we did the work using an established brand to isolate category associations and overlaps. For a new brand in an existing category, we do similar work. However, we focus more on competitor and category metaphor elicitation. This lets us isolate ideas that are important to the category but not yet “owned” by any other brands. These up-for-grabs attributes present an opportunity to differentiate a brand within a crowded market.