B2C customer interviews are extremely powerful tools. They let you validate product-market need, drive new product ideation, and understand evolving needs and expectations.

However, without a structured approach for developing your interviews, you may find the results lacking. That would be a darn shame considering how much time it takes to perform interviews in the first place, not to mention the missed opportunity to build your business strategy.

Never fear! With an organized process for building your interview project, designing the research approach, and executing the study, you can gather the actionable data needed to drive business strategy forward.

Why Do Interviews (And Not Surveys)

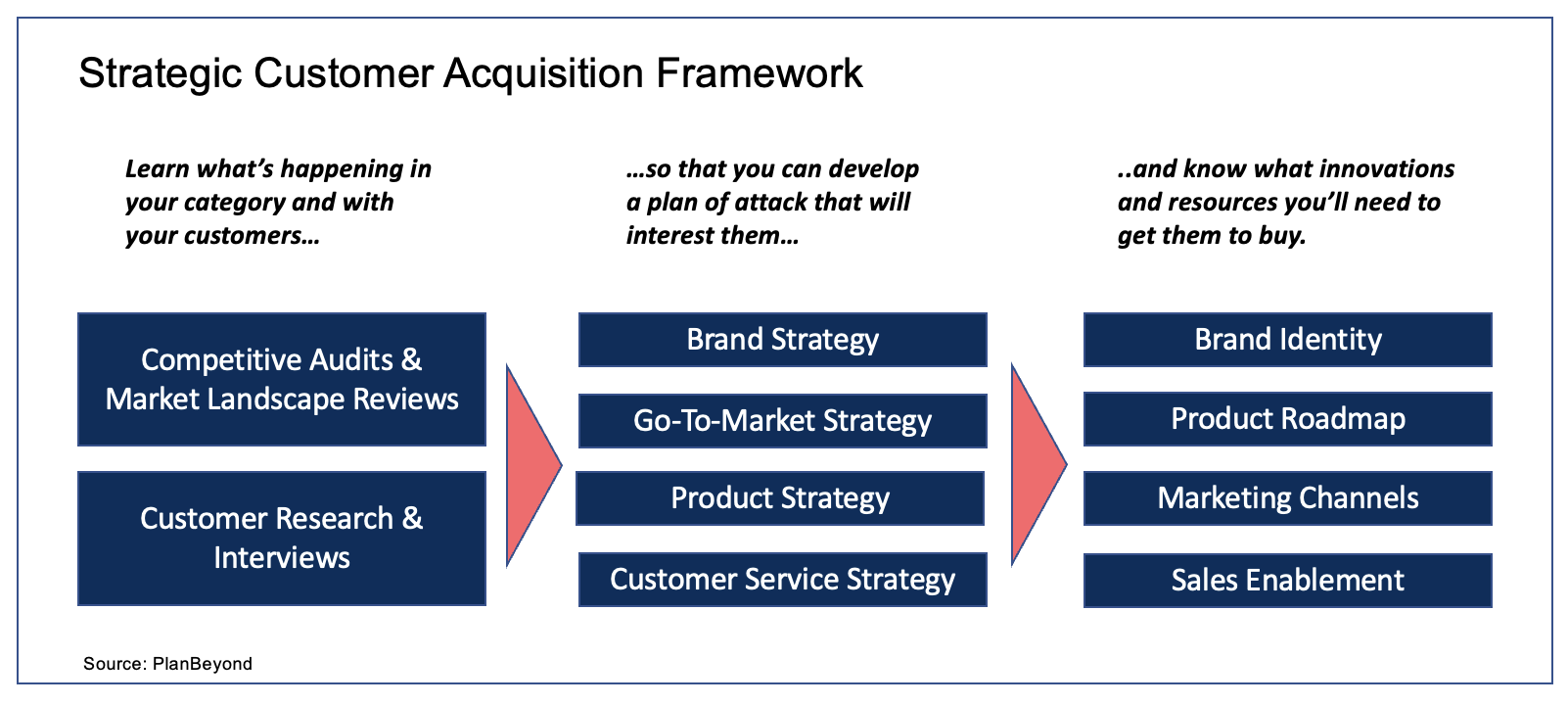

Market research, regardless of what form it takes, is a key input in any strategic plan. As you can see in the image below, it should front-end any larger strategy, product, or marketing planning.

That said, you need to decide if interviews are the right path forward, as opposed to pulling in secondary research, performing structured survey work, or something else.

When in doubt, see how much you agree or disagree with the following types of statements:

- “I can succinctly describe who our customer is.”

- “I can pare down why they buy from us in 3 or 4 statements.”

- “Am I confident I know the breadth of things customers want from us in terms of products and services.”

- “I understand the reasons customers buy from us.”

- “I generally know why customers don’t choose to buy from us.”

The more you disagree with these statements, the more uncertainty you have about customer profiles, customer drivers, or competitive factors. This is the ideal place for customer interviews!

When you know less about customers, it’s better to use interview questions. They offer a structured way to uncover things you don’t know while solidifying trends or hunches you’ve been building along the way.

How Do B2B & B2C Customer Interviews Vary

At the end of the day, something is compelling a customer to buy a product or service. It doesn’t matter if they are a consumer buying it for themselves or a customer buying it for their organization. Something triggered that buying muscle.

That said, B2C and B2B customers do differ in a couple key ways that ultimately influence how we structure one-to-one interviews.

- More Emotional Components: The idea of the impulse buy is central to B2C customers. Not so much B2B customers. While B2C customers may have a need in mind when purchasing products, emotions often drive their decisions. Think about phrases B2C customers sometimes make like, “Oh, it was just so cute” or, “I just had to have it.” Something triggered an emotional connection and got them to buy. In contrast, B2B customers tend to keep tangible objectives in mind when making a product purchase. It’s not that emotions don’t sway them. Instead, it’s that they aren’t as compelling a factor. As a result, we make sure to use our B2C customer interviews to understand how a product or service makes a customer feel…or makes them want to feel.

- Stakeholders / Decision Makers: When buying a product for yourself or your household, there aren’t that many stakeholders. B2C customers may just have their needs in mind. Or, they may factor in a spouse or partner, children, or friends. It’s a very small set of influencers. This stands in stark contrast to B2B influencers which sometimes include colleagues, managers, subordinates, procurement teams, and many more. This dynamic drives us to really explore intrinsic needs during the interview process.

- Shorter Assessment Process: The last two factors take us to this third point. With more emotional components and fewer stakeholders, the purchase decision tends to happen faster. This cycle may be as little as 20 seconds for a consumable product, or a few weeks or months for a bigger ticket item. In contrast, B2B sales cycles sometimes go as long as 18 months. With such a short cycle, it becomes critical to use interviews to to understand need states at a moment in time that drive purchases.

The Standard Interview Project Workflow

To drive successful B2C customer interviews, there’s a typical process you’ll want to follow.

1. Set Your Learning Objectives The very first step in any interview project should be to pinpoint the key things you want to learn when you’re done. Get together with your team and isolate 3-4 key learnings. This does two things. First, it provides the foundations for how to build out your interview discussion guide. Second, it aligns the team around a key set of goals (or shows them they need to get aligned).

2. Identify What Type Of Customer You Want To Talk To A customer can be so very many things. It could be a repeat customer, a lapsed customer, or a new customer. It can be someone that has never bought a certain product from you or someone that buys a little of everything. Based on your learning objectives, you should be able to put some parameter behind the ideal interviewee. If you can’t, go look at your learning objectives again.

3. Determine How Many Interviews To Do A classic question in the interview world is, “What is the right number of interviews to do?”

We find that 8-10 interviews is a good rule of thumb. It’s just enough interviews that we see definite trends emerge. However, it’s not so many interviews that time and resources get spent needlessly. If you do end up wanting to interview very different types of customers, you’ll want to increase the number of interviews. That will allow you to see trends across unique groups.

4. Identify Where You Will Source Your Interviewees Typically, interviewees are found in one of two places. The first is a business’s customer database. When it comes to e-commerce businesses or business with an online component, this is a great way to source interviewees. You know they are customers, you know what kind of customer they are, and you have their contact information.

The second is through what’s called a panel company. Panel companies are in the business of building large contact databases for market research purposes. Through a series of screener questions, they isolate people who meet the desired criteria. This is an effective way to find interviewees when you don’t have an existing list of customers. However, the downside is cost.

5. Develop Your Discussion Guide. We’ll keep this short since we’ll go into much more detail about this shortly. Your discussion guide is the series of questions you will ask each and every interviewee. It’s how you develop the qualitative data needed to find trends across customers.

6. Reach Out To Customers & Invite Them To Participate You’ll need to connect with customers, either by email or phone, and invite them to participate. It often takes 2-3 outreaches before a customer accepts.

Be prepared to build a large list of potential customers. In the B2C customer interview world, we typically see less than 10% of people accept an interview. This rate is higher with more engaged or repeat customers and lower with lapsed customers.

7. Field Interviews & Analyze Results With a final discussion guide and people to talk to, you are ready for your interviews! You’ll likely field your interviews over the course of 2-3 weeks. Add in another week for analyzing results and identifying key trends.

Typical B2C Customer Interview Questions

The series of questions you ask during each interview is the foundation for capturing good, actionable data. Start with your learning objectives to develop broad, open-ended questions that get your interviewee talking. You’ll need to craft questions that offer structure while including probes and prompts to delve deep into specific topics.

There is no one set of go-to B2C customer interview questions. After all, your objectives guide which questions are the correct questions. Nevertheless, we do see similar types of questions appear again and again through our interview projects:

- Tell me a little about who you are. Technically, this is not a question. But, it starts getting your interviewee talking. It’s a great way to start learning about them and building a demographic and psychographic profile of what your customer is like.

- Who else is in your home with you. To understand who impacts purchase decisions in the home—children, spouse/partner, parents, roommates—it’s valuable to understand who plays a roll in our interviewee’s day-to-day life.

- What was going through your mind when you first bought our product? You’ll want to know what drives someone to buy your product. Asking them to think about a finite point in time helps jog ideas about where they were, what they were doing, and what they were thinking when they first bought a product. This provides great context about the purchase experience.

- Take me through your process for deciding to buy our product. This type of question is especially useful with longer sales cycle products. You’ll unearth information about the typical buyer journey and how customers evaluate your product.

- What are your experiences with similar products? This is the competitor question. This question lets you dig into what other products customers consider, and also how they think about evaluating products in the market. This question may also unearth places where competitors are weak, giving you opportunities to differentiate yourself.

- What made you buy it when and where you did? Whether an impulse buy or a thoughtful purchase, something triggers the buyer to actually buy. This type of question lets you identify key decision making points or factors that get someone to finally purchase.

- What concerns did you have before buying? Ideally, customers buy with complete peace of mind. Unfortunately, this isn’t always the case. Use this question to identify ways to improve the marketing or sales process so customers don’t hesitate to buy.

- When do you think about using/wearing/eating/etc. our product? This question gets us into usage context. We get a sense for the general environments they’re using a product in and who else is in that environment. By understanding this, we can sometimes glean what appearances they want to give as a result of using a product.

- Tell me more about what’s going through your mind when you’re using/wearing/eating/etc. our product. Get to the heart of emotional drivers with this type of question. You’ll unearth the (hopefully) positive feelings that your product evokes and what the user thinks the product stands for.

- What would keep you from buying our product again? Good products and services enjoy high retention or repurchase rates. Unearth what hampers these rates by understanding issues with the product experience.

- I’d like to get your opinion about a new [package/flavor/design/etc.] that we’re thinking about offering. Your team is likely thinking about new product innovations. Give them guidance by using customer interviews to collect product intel. You can ask about what people do and don’t like about a product idea. You can also ask them to pick their favorite to let your team prioritize their efforts.

Do You Need Incentives To Field Customer Interviews

When it comes to B2C customer interviews, we have a very strong position on this. Yes, offer incentives.

Customers are busy and need a reason to stop what they are doing. Further, many B2C customer brands do not have a strong direct relationships with their customers. An email or phone call asking them for 30-60 minutes of their time won’t get anyone to say, “yes.” Incentives help get through this fog.

Of course, this brings us to the the classic follow-up question, “What kind of incentive do I give?”

There is no hard and fast rule for this. We suggest really looking at who your customer is in terms of demographics and psychographics to make that assessment. Here are a couple ways to think about it:

- Promo Code For Your Product: If you sell a low-to-moderate value consumer good that someone is going to want again, gift cards are great. Who doesn’t want a little extra money to pay for an extra pair of shoes or glasses. These tend to be in the $10-$30 range, depending on the product price point.

- Amazon Gift Card: Another great option is an Amazon gift card. This option is ideal when you just want to give an interviewee cash, but need a trackable, business-friendly way to do so. $30 gift card are a good starting point for an everyday consumer and a relatively short interview. Definitely consider going up to $200 or more for more affluent consumers and/or longer interviews.

- Non Profit Donation: Offering to donate to a non-profit is a good last option. This is particularly true if your product aligns with some particular social mission. As above, these donations can range from $25 to $100 depending on the type of customer and the interview length.

Cash tends to be king. As a result, usually the promo code or gift card is the way to go. We tend to only suggest non profit donations if there’s a need to avoid direct cash transfers to customers, or if the customer is the type who would be extremely compelled by supporting a particular non profit group.