As market researchers, a really common question we hear from clients is, “Should I do quantitative or qualitative research?”

We say it’s not about the research methods. It’s about the broader business questions you have, and the conditions you find yourself in. After all, very few people are doing research for the sake of research. Instead, research should be in the service of driving better, smarter business decisions.

Let’s break down the typical scenarios we see that help us initially isolate whether quantitative or qualitative research is the right choice. We’ll explore each method in more depth so you’ll understand why that is.

Using Business Conditions To Determine The Best Research Method

Sure, we’re research folks so we love talking about quantitative vs qualitative research. But, we work with organizations and businesses that don’t care about the research method. They care about answering key business questions…not to mention answering them within the context of their broader category.

That’s why it’s important to start with the questions and challenges first. They are a natural starting point for determining which method is best.

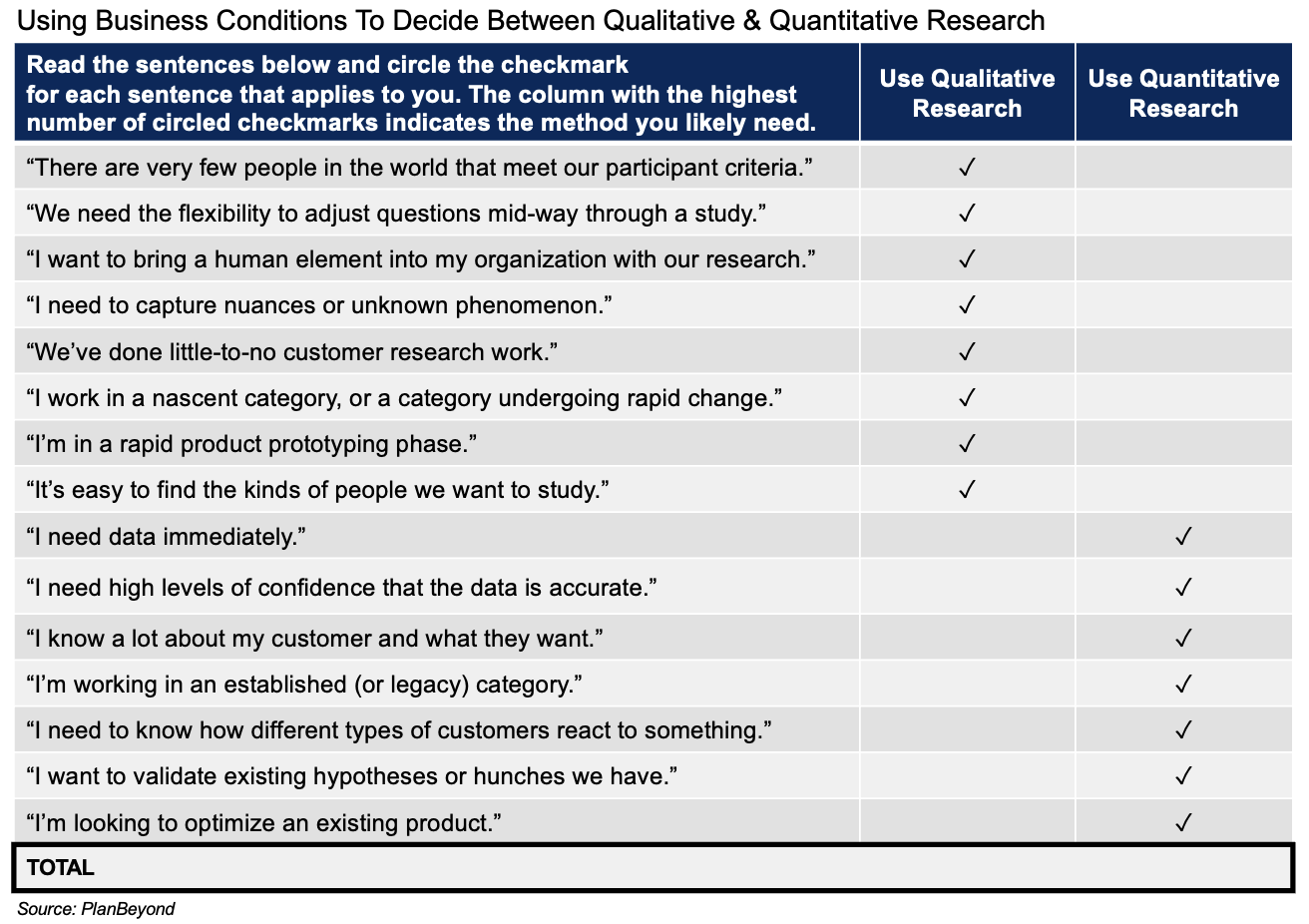

Let’s look at the table below to get a general gist of things.

In essence, use qualitative data when your organization is just getting started with research. This tends to be the case with startups and businesses working in very new industries. It’s also true when launching very new products or entering new categories.

This is because qualitative research is great when you don’t know what you don’t know. Its open-ended approach lets you collect raw, unfiltered ideas direct from participants. Sure, processing and analyzing that feedback is challenging. But, it is rich, nuanced, and great for heading you in the right direction.

On the flip side of things is quantitative research. We say go quant when you’re ready to test ideas, hypotheses, or working hunches. This usually means you’ve done some research in the past and you have a good understanding of your customers and the broader industry you work in. If you’re in product optimization mode, this is where to go.

This is true thanks to the numeric underpinnings of quantitative research. Capturing lots of data points on very fixed question lets you see clear patterns and preferences among customers. As a research method, it builds strong confidence about which direction to move into.

The Differences In Qualitative vs Quantitative Research Execution

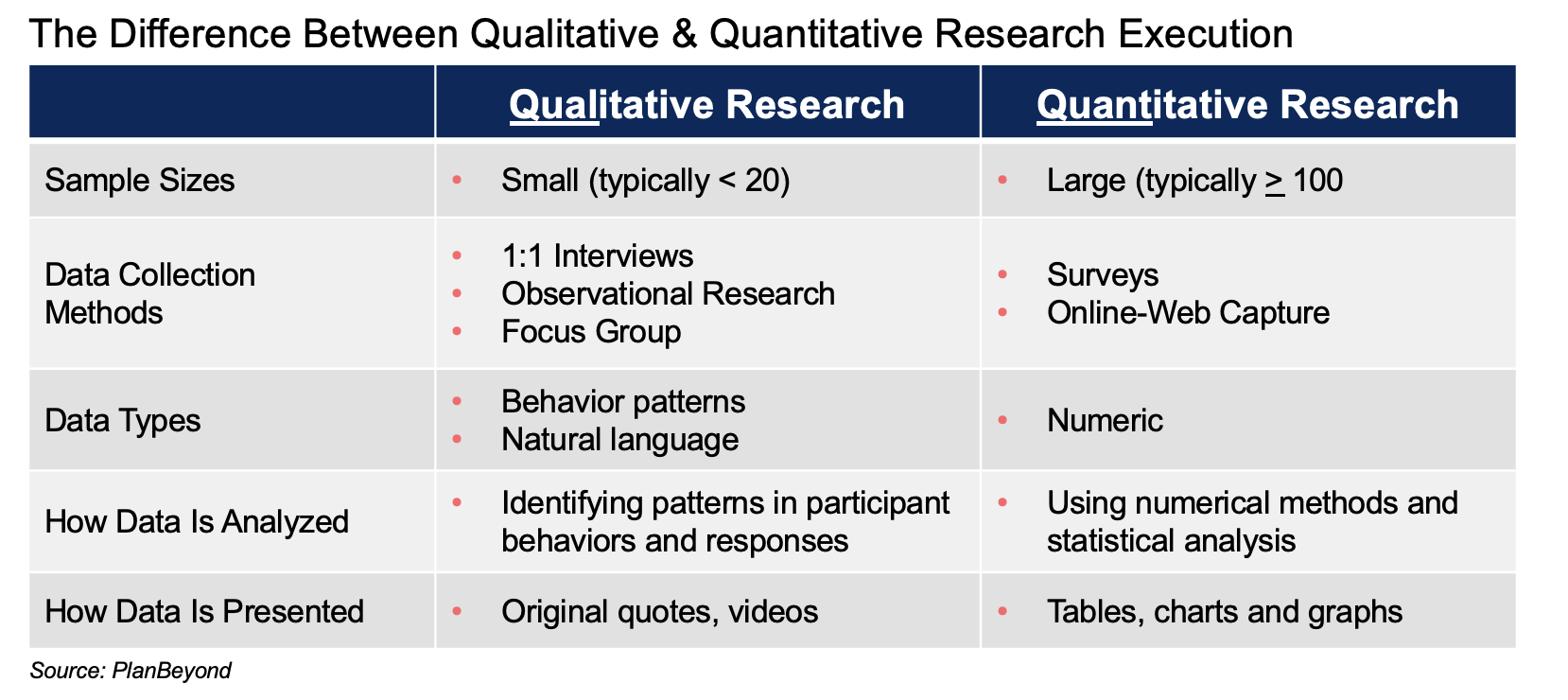

To understand the generalizations we just made, we need to look at the methods themselves.

Qualitative research generally collects information from a small number of participants. This information comes in the form of observations, captured dialogue, or interviews. In contrast, quantitative research leverages tools like surveys or automated, online data collection tools to capture numeric data.

Because the data itself is so different, so is how we analyze it. With qualitative research, we’re looking for patterns in what people say or what people do. Meanwhile, with quantitative data, we aggregate numeric responses and look for patterns in those numbers.

[stm_spacing lg_spacing=”25″ md_spacing=”15″ sm_spacing=”10″ xs_spacing=”5″]

The Strengths Of Qualitative Vs Quantitative Research

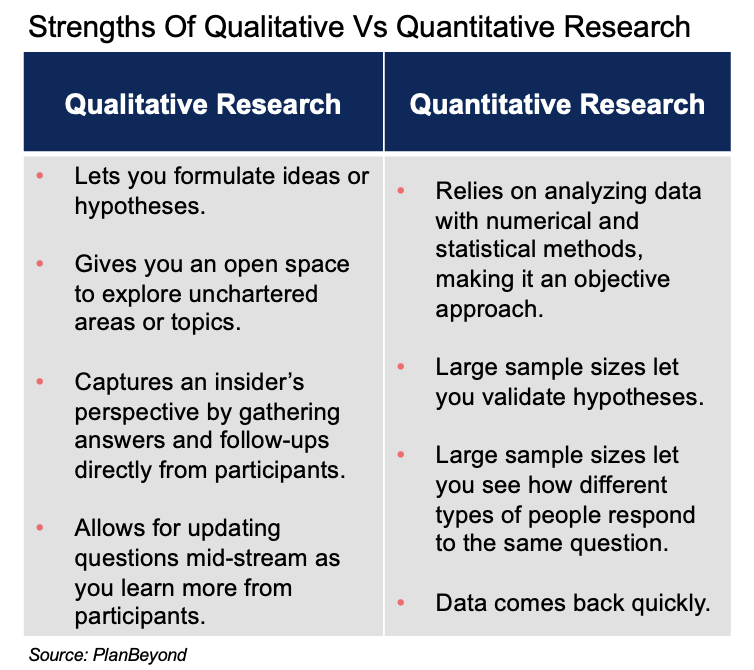

Qualitative Research Strengths

Qualitative research lets you spend a lot of time with individual respondents. This makes it a fantastic way to get deep, nuanced insights. Posing open-ended questions to participants lets you explore completely fresh topics and generate hypotheses about the market and what customers want.

Additionally, qualitative research lets you revise questions midstream. As you learn more with each interview or focus group, you can revise your questions. You get less quantity of responses but far more flexibility to adjust what you learn.

Quantitative Research Strengths

In comparison, quantitative research offers confidence and certainty. With large sample sizes, you can apply objective statistical methods and read results across different segments in your data sample.

Another big upside is speed. Surveys take as little as 2-3 days to complete meaning you get data back quickly.

Asking about the differences between quantitative vs qualitative research implies you have to make a choice. Not necessarily!

In the ideal world, you do both. Spend time performing one-to-one interviews or fielding focus groups first. This helps you get a lay of the land and better understand customer needs. During this time, you’ll start hearing trends and formulating hypotheses. Or, in the case of product research, you’ll see definite likes and dislikes among customers.

Follow up this initial data collection phase with surveys. You’ll validate your hypotheses and give your team greater confidence about the direction to head into.