Pricing a product or service is really hard. For some, it’s one of the hardest components of any go-to-market plan. Understandably so.

Price a product too high and you risk customer alienation. Price a product too low and you leave money on the table. But, if you find the sweet spot, you maximize revenue and customer acquisition.

How do you find that sweet spot? By using price elasticity research. Also called the Gabor Granger method, price elasticity research gives you an objective read on how sensitive customers are to price and therefore just how much you can really charge.

What Is The Gabor Granger Pricing Model

Developed in the 1960’s by economists André Gabor and Clive Granger, the Gabor Granger model measures the price elasticity for different products or services. Said more simply, it lets you see how much or little customers react to a change in a product or service’s price.

This idea of elasticity is crucial when it comes to determining price points. When price is elastic it means that even small changes in price result in major increases or decreases in customer demand. In contrast, when price is inelastic it means changing price has little change in customer behavior. By understanding how price changes behavior, you know how much liberty you have to increase price.

Because Gabor Granger centers on assessing price elasticity, it is ideal when you have the following goals:

• Determine how much customers are willing to pay for a product or service

• Optimize a product or service’s profitability

Notably, Gabor Granger only focuses on price point. That is, we have no interest in determining how changes in other dimensions like features, functionality, or other factors impact willingness to pay. If that’s not the case, there are other methods better suited to measuring customer demand.

How Gabor Granger Helps Maximize Profit

Unlike other pricing approaches, Gabor Granger is notable for its ability to help companies maximize profit by assessing customers’ willingness to pay.

For instance, the cost-plus pricing approach is based off of a product or service’s cost. Companies assess the cost of delivering a product or service. They then apply a fixed mark up. Sure, they make a profit. But, if customers are willing to pay a higher mark up, these companies leave money on the table.

Another example is using competitive pricing. Under this approach, companies use standard pricing that already exists to determine their price point. However, competitors may use the cost-plus approach. Or, their products or services may not offer the same benefits. If either of these are true, companies will once again leave money on the table if they just use this approach.

In contrast, as we’ll see below, Gabor Granger used feedback to directly from customers to pinpoint what they are willing to pay. And, where they are unwilling to pay. This direct intel from customers is key for revenue maximization.

How Gabor Granger Works

The Gabor Granger research approach uses a sequential series of pricing questions to identify any given respondent’s preferred price point.

To begin with, you’ll need to determine the pricing levels you want to test. For instance, for high-value items like washers or dryers, you may want to use price points in $50-$100 increments. Meanwhile, for everyday consumer goods you may want price points that change in $.50 or $1.00 increments.

From there, respondents will see a description of the product. Via a survey they will be asked:

“How likely are you to buy this product at [ENTER PRICE]?”

1. Extremely likely

2. Very likely

3. Somewhat likely

4. Not so likely

5. Not at all likely

Respondents select one of the five answer choices. Anyone selecting extremely or very likely will see the same question. But, this time the price point will go up. Meanwhile, anyone answering somewhat, not so, or not at all will also see the same question again. But, the price point will go down.

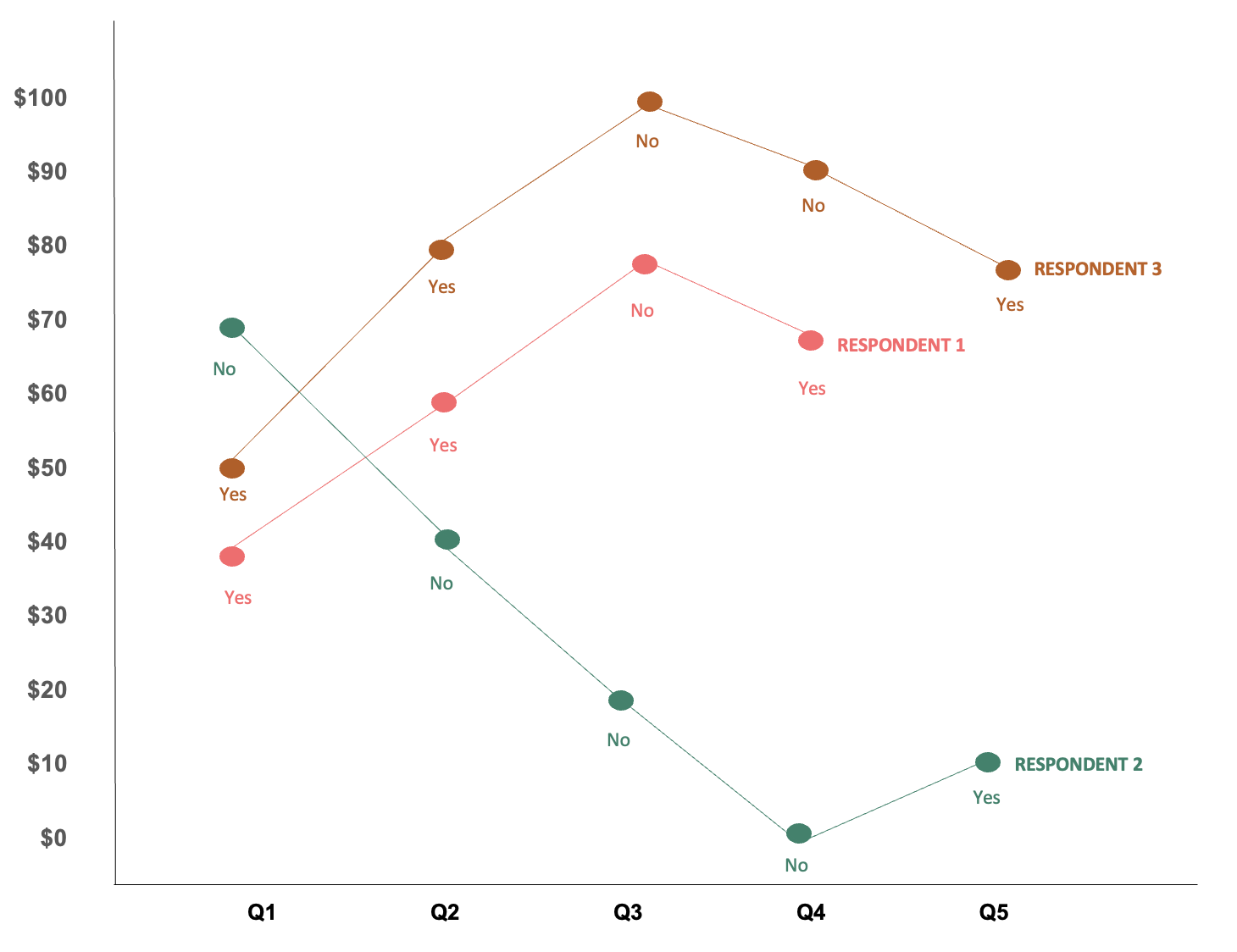

This process continues until we determine the maximum amount any given respondent is willing to pay. Take a look at the graph to the right to see this in action.

Intel Gained From Gabor Granger Price Elasticity

Once data is fully collected across all respondents, we start understanding how customers truly react to changes in price.

Price Elasticity

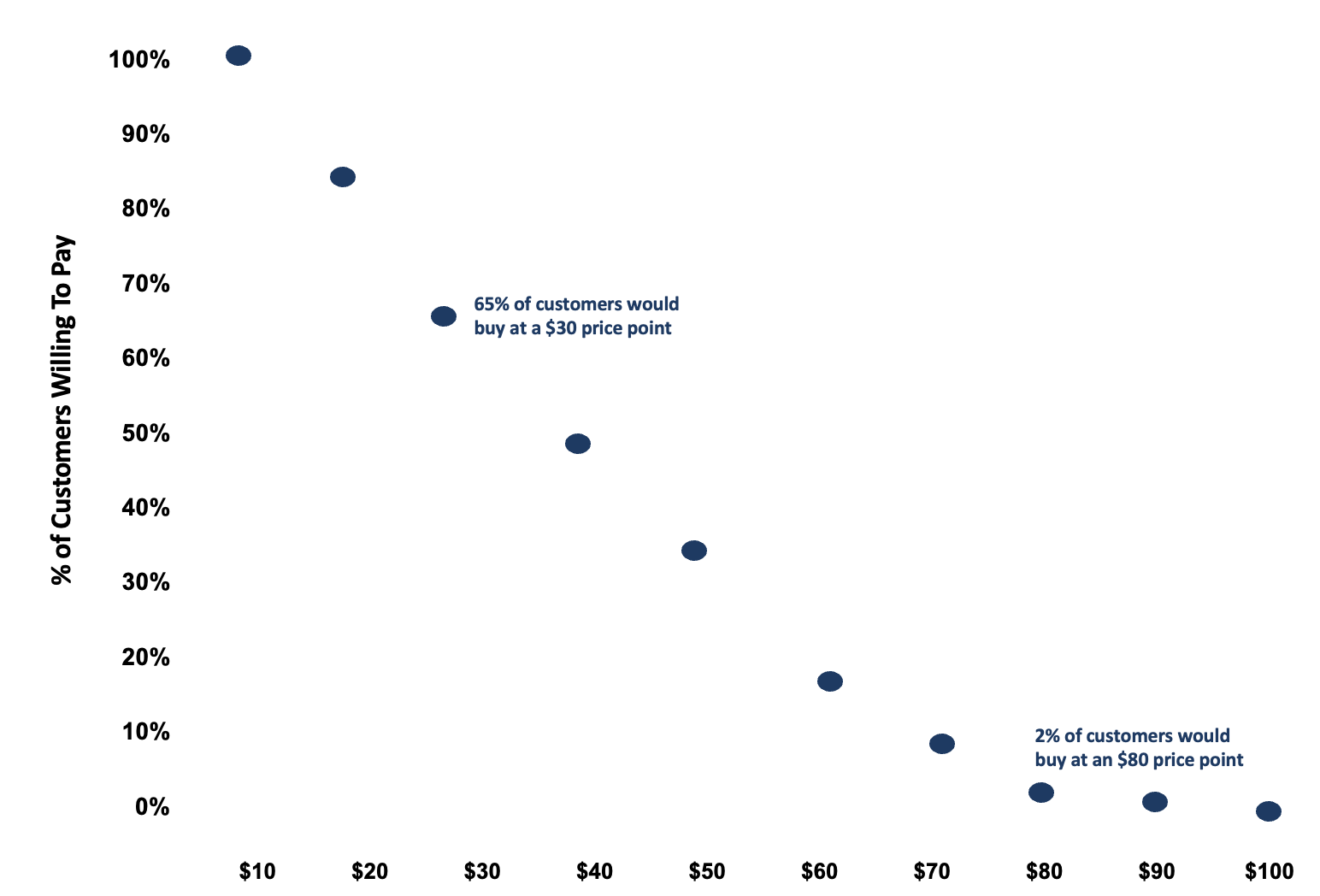

One of the most important outputs from this type of research is understanding how customers’ willingness to pay changes at different price point.

We see an example of this in the graph to the right. In this case, we have a steep curve. What this means is that customers are very price sensitive. Changes in price have large changes on demand. If we saw a shallower curve, we’d instead determine that customers are fairly price inelastic. That is, changes in price do not have a big impact on their purchase behavior.

Revenue Potential Versus Price

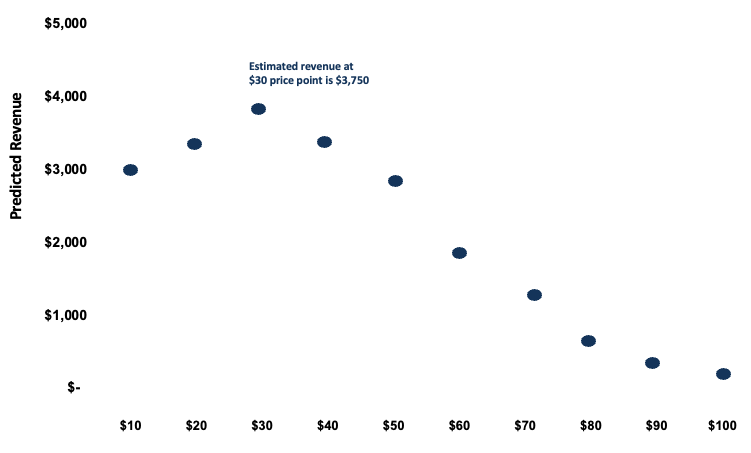

The other valuable output is a graph isolating where the highest revenue potential exists. This aims to maximize the sweet spot where companies can charge the highest price possible while still keeping willingness to pay levels fairly high.

This graph factors in that some drop off in customers is worth it because it’s possible to extract just a bit more out of those that will stick around.