We perform brand awareness studies because a brand is such an important thing.

Studies show the stronger a brand’s awareness, the more likely people are to buy it. In fact, brand awareness has positive impacts on customer lifetime values (LTV) and customer acquisition costs (CAC).

Why? Because trust matters. And a brand, if anything, is a way for companies to tell you what you can trust them to do. It’s the product of years of deliberate work on very tangible things (e.g. quality, consistency, availability) marketed in a particular way (e.g. positioning, messaging).

This is why we do brand awareness studies. They objectively measure how many people know about you. And, they hopefully tell you how much people trust you to deliver.

Why Perform A Brand Awareness Study

Let’s dig into the key reasons you’ll want to perform a brand awareness study.

Benchmark Where You Stand Today In The Market

Remember the old Peter Drucker saying, “What gets measured gets managed?” This is what brand awareness metrics are all about. You can’t take stock of your position in the market without measuring it! The same is true of your competitors too. Measuring competitor awareness tells you exactly where everyone stands.

Measure The Impact of Marketing Efforts

Marketing activities should increase awareness for a brand. Increases in purchases or information requests follow thereafter. This is why you’ll want to take a brand awareness benchmark before you start marketing campaigns and then again after. This lets you see how things are trending. And, if they aren’t trending well, it gives you a chance to re-jigger things.

Proactively Identify Upstarts In The Market

New brands pop up all the time. It’s hard to keep track of it all. However, by measuring customers’ awareness of category brands, you have a proactive way to see if anyone is taking hold. Or, if you’re the upstart brand, you can assess if your brand awareness is getting traction.

We want to be explicit that brand awareness studies are not just about measuring your own awareness. Measure competitor awareness too. This gives you a complete, holistic picture of the ecosystem you do business in.

The Key Brand Awareness Metrics

When performing brand awareness research studies, you should always measure two types of awareness: aided and unaided awareness.

Measuring Unaided Brand Awareness

We like to say that unaided brand awareness is the holy grail of branding. This is because unaided awareness is a way to measure top-of-mind awareness. Here’s how it works. You ask participants to name all the brands that come to mind for a given category. You then give them an open space to list out as many brands as they can think of.

Let’s use the athletic shoe category as an example. We would pose the following statement, “Please list all of the athletic shoe brands that come to mind.” Respondents then see an open box where they can type as many, or as few, brands that come to mind.

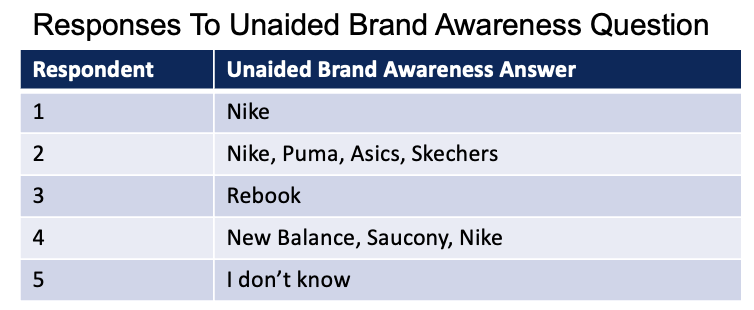

When reviewing the raw data, we’d see something like the table to the left. For each respondent, we see at least one entry. That entry may be a single brand, it could be many brands, or it could be some variation of “I don’t know.”

Once you collect the raw responses, you then tally up the number of times each brand was mentioned, and then divide it by the total number of people in your study. Let’s say 20 people out of 200 mention Saucony. This means that Saucony enjoys 10% unaided brand awareness.

Measuring Aided Brand Awareness

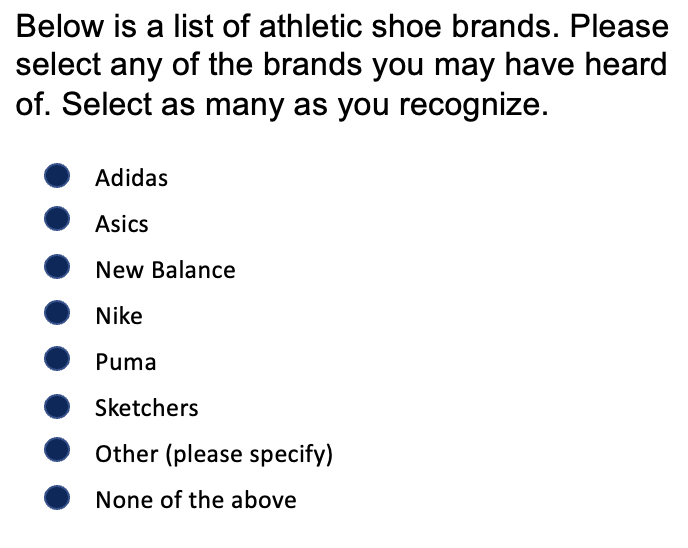

The next metric to measure in a brand awareness study is aided brand awareness. This is essentially a measure of recall. Research participants look at a list of brands and select all of the brands they recognize.

Let’s keep using our athletic shoe brand to see how we measure aided awareness. We show respondents a large list of brands. They then select the brand names they recognize.

Once we collect the raw data, we determine how many times a brand is selected compared to the number of people taking the survey. For instance, let’s say Saucony is selected 50 times out of a survey with 200 respondents. This lets us say that Saucony has 25% aided brand awareness.

How To Perform Your Brand Awareness Study

Let’s go through a quick rundown of how to actually execute your brand awareness study and look at its results.

1. Draft & Revise Your Study Questions

Start by writing out the questions you want in your study. Of course, this includes your unaided and aided brand awareness questions. But, it can include other questions too. For instance, you may want to learn more about how people perceive your category, your brand, or competitor brands.

Ideally, you have other people review your survey. This lets you bring in new perspectives and further refine your questions.

2. Program Your Brand Awareness Study

We haven’t said it explicitly. But, brand awareness studies are generally quantitative studies. That means we use (usually) digital surveys to capture responses. As a result, you’ll need to take your drafted questions and program them into a survey platform. Once programmed, be sure to take it several times. You’ll see how respondents experience the survey, giving you a chance to revise anything you don’t like.

3. Collect Survey Responses

You now need people to actually take your survey.

There is no hard and fast rule about how many people you must survey. However, we like sample sizes that allow for no more than +8% margin of error. That’s a specialized way of saying we want to survey enough people that we can feel confident in our survey results. The greater your sample size, the lower your sample error.

4. Code The Unaided Awareness Question

Questions that capture free form text need to be coded. This means someone reviews each response and attributes it to a particular tag. For instance, responses with “Socony,” “Saucany,” or “Socny” get tagged as “Saucony.” It’s a time intensive process, but necessary with open text responses.

5. Review Responses To Aided Awareness Question & Other Survey Questions

You now can aggregate responses to each of your other survey questions. This lets you see exactly where brands stack up on aided awareness as well as the other questions you asked. Using statistical methods and significance testing lets you further identify patterns and relationships within your data.

6. Review Responses By Customer Segment

It’s great to see aided and unaided awareness across all respondents. However, maybe awareness differs by gender, age, job title, or some other feature. If this is the case, you’ll want to split your data across each of these groups to see how these unique segments respond to each survey question.

Where to Source Research Participants

Let’s now circle back to the issue of finding participants for your brand awareness study. When it comes to this component, you have two things to work through.

1. Determine Your Participant Profile

First, determine who you want in your study. Usually, you want people that could potentially purchase your product. In the B2C world, this means finding people who previously bought or would consider purchasing something from your product’s category. For instance, if you’re Heinz ketchup, you want people who have or will buy ketchup. Conversely, for B2B items, this means people in a position to buy your product. For instance, if you’re Mailchimp, you want people who are responsible for email marketing in their organization.

2. Determine Where You Will Find Your Participants

Brand awareness studies usually require hundreds of research participants. This means you need to find them. We generally source participants from one of two locations.

Research Panel Companies

Panel companies specialize in building databases of people who have opted-in to participating in assorted research like surveys and interviews. By using targeted questions called screeners, panel companies help you find people who meet your participant criteria. The upside of panel companies is you have greater confidence that you’ll get enough respondents. The downside is that there is a cost per respondent.

3rd Party Databases

There are also more tangential ways to find participants through 3rd parties. For instance, one approach is leveraging sales enablement databases like Hoovers. These tools let you filter contacts by B2B demographic criteria so you can build a list of relevant contacts. This approach lets you take advantage of existing tools in your organization, minimizing research costs. However, it requires cold outreach which may have limited response rates.

People sometimes wonder if they can use their own business’s contact database. The answer to that is easy. No, you cannot! This is a very biased set of contacts because they already know your brand. After all, how else would they be in your database to begin with? Be sure to use a contact source that is objective and lets you get an accurate picture of your market landscape.