Product concept tests are a fantastic way to do mitigate business risk. Rather than launching products and hoping customers love them, concept tests let you assess customer appeal first. It’s a time-tested market research approach to increase the chances of products actually resonating with customers. And, it helps you avoid launching one of the 95% of new products that fail every year.

There are a variety of ways to execute this work. Let’s focus in on qualitative product concept tests specifically to see what they’re all about and when to use them.

How To Run A Qualitative Product Concept Test

First off, let’s look at what a qualitative product concept test entails. Once you have a gist for what this looks like, you’ll be able to easily identify when it’s the right research approach.

1. Start With A Product Concept

You’ll first need a description of the product you want to test. This can be as simple as 2-3 sentences, or a much longer description with features and benefits. Don’t skimp on spending time on this step! You’ll want to develop concept ideas that are easy to understand on their own. When you do, you’ll be sure people can effectively evaluate if the product is right for them.

2. Share the Concept Via Qualitative Methods

When your concept is ready, it’s time to share it out! You typically have to options with qualitative testing. You can share the concept via one-to-one interviews. Or, you can share it with multiple people in a focus group setting.

Regardless of which option you choose, the process is the same. You’ll want to read the concept out loud to everyone. At the same time, make it available for them to read too. Feel free to read it twice or give participants a moment to re-read the concept themselves. You want them to fully capture what the product concept is all about.

3. Ask For Feedback

Once the concept is shared, it’s time to collect feedback. You can ask a wide variety of questions at this stage. However, we tend to always use some variation of the following questions:

- What initial thoughts, impressions, or ideas come to mind?

- What do you like about this product idea?

- What don’t you like about this product idea?

- Does this make sense for you / your household / your business? Why/why not?

- Does this address a current need or pain point? If so, what?

- Would this replace something you’re using today? If so, what?

4. Look For Trends Across Feedback

Now it’s time to look at feedback trends from your research participants.

Of course, you want to hear if participants do or do not like a particular concept. However, the real value in running a qualitative concept test comes from identifying intrinsic drivers or broader environmental factors that impact product appeal. When you get down to this level, you have the key inputs you need to not just understand why something resonates but also how to develop future products that will also have appeal.

Sure, we are relying on small sample sizes. Nevertheless, you’ll spot trends in just one focus group or after speaking with 4-5 people in one-to-one settings. Ideally, you’ll collect feedback from at least 8-to-10 individuals. We find this tends to be the sweet spot in qualitative testing.

When To Use Qualitative Product Concept Tests

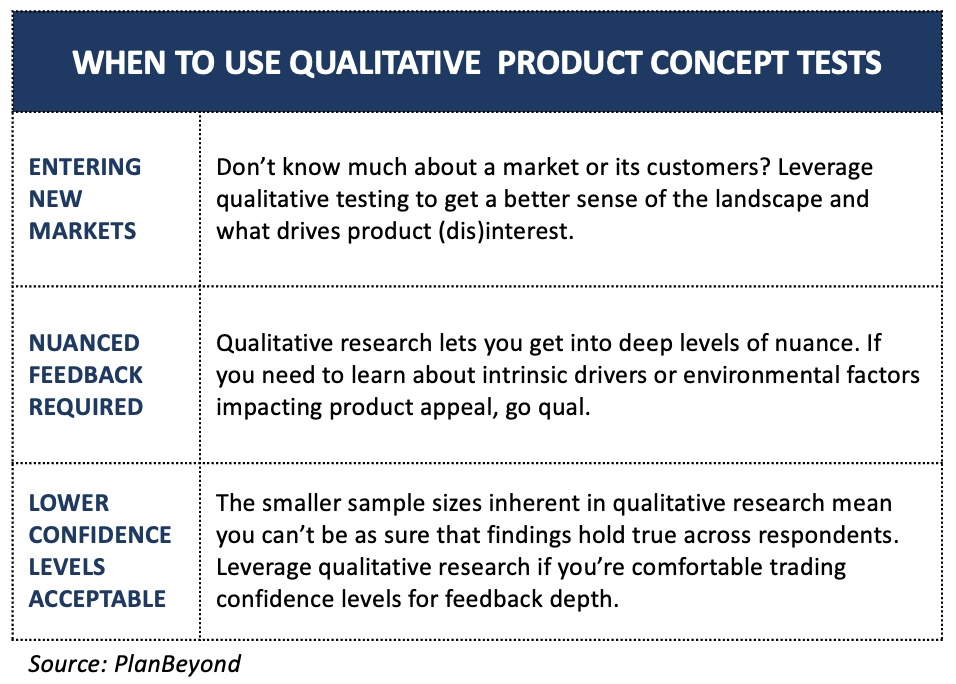

Concept tests can take one of two forms: quantitative surveys or qualitative interviews or focus groups. A qualitative product concept test is the right choice if the following factors hold true:

- Entering A New Market: If you don’t know what you don’t know, you’ll need to test the waters first. Qualitative approaches let you understand new customers or markets and their rationals for liking or disliking specific types of products.

- Nuanced Feedback Needed: Qualitative research is incredibly effective at capturing fine details and nuance. If you’re at a place where you need hyper-detailed feedback rather than broader inputs, go qualitative.

- Okay With Uncertainty: Qualitative research leverages smaller sample sizes versus quantitative research. While you get deeper insights, fewer respondents means lower confidence levels that the feedback holds true across all customers.

Keep in mind, you can always start with qualitative approaches and then transition to survey-based concept tests. This will get you the best of both worlds! You start by understanding broader customer needs and the market landscape with detailed qualitative feedback. Then, move toward building concept appeal certainty with higher-sample sized survey research.

Let your broader organizational factors, learning objectives, and market position determine if the qualitative approach is right for you.